Jim Power

Note: a big budget deserves careful and extensive analysis. If your email program truncates this post, you should still be able to click through and read the whole thing. Please get in touch if you have any problems or questions.

Budget 2024 was always going to be a difficult balancing act given the prevailing economic and political backdrop. In the event, the Government delivered a very substantial fiscal package that has an inordinate number of measures, which will impact widely throughout the Irish economy and society. It tries to address everything possible, but resources are being spread very widely across the economy. Everybody will be slightly better off, but nobody will be significantly better off. It is a catch-all budget offering.

The economy is operating close to full capacity and bodies such as the Irish Fiscal Advisory Council (IFAC), the Central Bank of Ireland and the ESRI have warned of the dangers of injecting too much stimulus into an economy already operating at high levels of capacity. However, there are still intense pressures on many small businesses and households due to elevated costs of living and high costs of doing business.

Consumer price inflation averaged 7 per cent in the first eight months of the year, with mortgage costs, and higher food and energy prices putting intense pressures on households. For smaller businesses, the cost environment is very challenging with energy costs and wage pressures causing significant problems. The Government announced in the budget that it is going to push ahead with the implementation of an increase in the minimum wage from €11.30 to €12.70. This will further pressurise the operating environment for many small businesses.

Although the economy is still performing quite strongly, the risks to the economy are now very clear. The global economic outlook is weak and uncertain; energy prices are very volatile; international and domestic long-term interest rates are rising at an alarming pace; and central banks around the world have delivered a very aggressive tightening of monetary policy over the past 18 months, and the cycle may not have peaked yet. Domestically, the elevated cost of living; higher interest rates; and the weaker global economic backdrop are bound to have a negative economic impact over the coming year. The Irish economy cannot logically remain immune to these external and domestic pressures.

The latest economic outlook from the ESRI (4th October) predicted that GDP would contract by 1.6 per cent in 2023 and expand by 3.5 per cent in 2024. The more meaningful measure of domestic economic activity, modified domestic demand, is forecast to expand by a modest 1.8 per cent in 2023 and 2.4 per cent in 2024. This downward revision to growth prospects is driven by the slowing global economy, and the impact of the elevated cost of living pressures and higher interest rates on consumer spending. Consumer spending is forecast to expand by 3 per cent this year and 2.5 per cent in 2024.

The ESRI is arguing that the post-Covid bounce is now ending, and growth is reverting to more normalised level of activity. External developments could exacerbate the slowdown over the coming months. In relation to fiscal policy, the ESRI is warning that tax cuts should adjust for wage inflation only and that the breach of the 5 per cent expenditure growth rule can only be justified if the excess spending is used to boost investment.

The weakness of corporation tax receipts in August and September is also a cause for some concern, as the tax take is very heavily reliant on a small number of large multi-national companies.

From a political perspective, Budget 2024 is the second last budget before the next general election, which must be held by February 2025; and the final budget ahead of the local and European elections next year. It could be the last general election, depending on the cohesion of the coalition in 2024. Faced with this political reality, there is obvious pressure to deliver as expansionary a package as possible, with a focus on spreading the gains thinly across as much of the economy and society as possible. The economic and political realities clashed in Budget 2024 and the political reality won the day. In the event the Government pursued a very expansionary fiscal approach, with significant increases in expenditure and some easing of the tax burden.

KEY FEATURES OF BUDGET 2024

In framing Budget 2024, some priorities were evident:

· Impact of elevated inflation and rising interest rates on the cost of living.

· The increased cost of doing business for small businesses.

· The ongoing pressures on the rental market for both private landlords and renters.

· The pressure on mortgage holders resulting from the increase of 4.5 per cent in ECB official interest rates since July 2022.

As stated in the Summer Economic Statement and reiterated by the Minister for Finance in his opening statement to the Committee on Budgetary Oversight in September, the core package in Budget 2024 would be €6.4 billion, comprised a little over €1.1 billion in taxation measures and core expenditure of just under €5.3 billion. This would bring net core spending growth to 6.1 per cent, which is well above the 5 per cent expenditure target set out in the Government’s original medium term fiscal strategy. This is being justified based on the ongoing cost of living and cost of doing business pressures, which are still intense.

In addition to the pre-announced package of €6.4 billion, there was a significant package of once-off cost of living measures of €2.7 billion, and non-core expenditure of €4.75 billion. Total package of €14 billion.

The key measures contained in Budget 2024 include:

Taxation:

· There is a reduction of 0.5 per cent in the 4.5 per cent USC rate that will now apply to incomes between €25,760and €70,044. The 2 per cent rate band ceiling has been lifted by €2,840. Incomes of less than €13,000 are exempt from USC.

· The standard rate threshold for income taxpayers has been increased from €40,000 to €42,000.

· An increase of €100 in the personal tax credit; the employee tax credit; the earned income credit, the home carer tax credit; the single person child carer tax credit; and an increase of €200 in the incapacitated child tax credit.

· The 9 per cent VAT reduction for gas and electricity is being extended by 12 months until 31st October 2024.

· The rent credit for private renters, which was introduced in Budget 2023, has been increased from €500 to €750.

· For private landlords, subject to certain conditions being met, rental income of €3,000 for the year 2024, €4,000 for 2025 and €5,000 for the years 2026 and 2027, will be disregarded at the standard rate, provided the property remains in the rental market for the full 4 years of the scheme.

· Three energy credits of €150 each will be given to households, between the end of 2023 and April 2024.

· In relation to Capital Gains Tax Retirement Relief, there will be an increase the age limit from 66 to 70 and a limit of €10 million on the relief available for disposals.

· Vacant Homes Tax – increase to five times the property’s LPT charge.

· The Research and Development (R&D) Tax Credit is being increased from 25 per cent to 30 per cent. The first-year payment threshold is being doubled from €25,000 to €50,000 to ‘provide valuable cash-flow support to companies engaged in smaller R&D projects.’

· A new capital gains tax relief for angel investors has been announced, which will allow these investors to benefit from a reduced rate of Capital Gains Tax when they dispose of a qualifying investment.

· The EII provides income tax relief for risk capital investments in qualifying small and medium enterprises. From 1 January 2024, the minimum holding period required to obtain relief is being standardised to four years for all investments, and the limit on the amount that an investor can claim relief on for such investments is being increased to €500,000. Further changes will be made to the scheme to reflect amendments to the EU General Block Exemption Regulation and details will be set out in the Finance Bill.

· The Government will be publishing legislation in the Finance Bill to implement the 15 per cent minimum effective tax rate for large companies as provided for under the OECD Pillar Two agreement.

· The Accelerated Capital Allowances (ACA) scheme for Energy Efficient Equipment (EEE) provides a tax incentive for companies and unincorporated businesses who invest in highly-EEE. The scheme is being extended for a further two years to 31 December 2025.

· A one-year Mortgage Interest Tax Relief will be introduced for homeowners with an outstanding mortgage balance on their primary dwelling house of between €80,000 and €500,000 as of 31 December 2022. The added relief will be available on increased interest paid on mortgages this year as compared with the amount paid in 2022, at the standard rate of 20 per cent income tax. The relief will be capped at €1,250 per property. Around 165,000 mortgage holders will benefit from the measure with an estimated cost of €125 million.

· The Help to Buy Scheme is being extended for a further year until 31 December 2025. The scheme is also being amended to reflect its interaction with the Local Authority Affordable Purchase Scheme (LAAP). This amendment will enable the use of the affordable dwelling contribution received through the LAAP scheme for the purposes of calculating the 70% loan-to-value requirement, thereby facilitating access to all LAAP purchasers to the HTB scheme. This will come into effect from 11 October 2023.

· Seventy-five cent added to package of 20 cigarettes. E-cigarettes and vaping products will be taxed in Budget 2025.

· A Future Wealth Fund is being set up to address long-term challenges such as ageing population. 0.8 per cent of GDP will be allocated annually, with the aim of reaching €100 billion by 2035.

· An Infrastructure, Climate and Nature Fund will be set up. €2 billion will be allocated annually for 7 years. In 2024, €2 billion will be allocated from the dissolution of the National Reserve Fund.

· The accelerated capital allowances scheme for energy efficient equipment is being extended for a further two years.

· The tax disregard in respect of personal income received by households who sell residual electricity from micro-generation back to the national grid is being doubled.

· The zero VAT rate on the supply and installation of solar panels is being extended to schools from 1 January 2024.

· The temporary excise rate reductions applying to auto diesel, petrol and marked gas oil which were due to expire on 31 October 2023 are being extended until 31 March 2024. Half of the outstanding amounts of eight cent on petrol, 6 cent on diesel and 3.4 cent on Marked Gas Oil will be restored on 1 April 2024, with the balance restored on 1 August 2024.

· In relation to the motor industry, there will be no increases in VRT; the VRT relief for battery electric vehicles is being extended to the end of 2025; the tapering mechanism applied to benefit in kind relief for electric vehicles is being enhanced by extending the current Original Market Value deduction of €35,000 until end 2025, followed by a reduction to €20,000 in 2026 and €10,000 in 2027; the temporary universal relief of €10,000 applied to the Original Market Value of a vehicle (including vans) for vehicles in Category A-D and the amendment to the lower limit of the highest mileage band is being extended to 31 December 2024; and the accelerated capital allowances on EVs will be extended for a further 3 years.

· The rate per tonne of carbon dioxide emitted for petrol and diesel will go up from €48.50 to €56.00 from 11th October as per the trajectory set out in the Finance Act 2020. It will apply to other fuels from 1st May 2024.

· The Minister for Finance is currently undertaking a review of the funds sector. The review will report to the minister next summer and will examine a ‘Life Assurance Exit Tax.’ Once the review is completed, the Minister will then consider any changes to the taxation framework.

· There will be an increase in the current project cap on qualifying expenditure in the Section 481 Film Tax Credit from €70 million to €125 million, subject to State aid approval.

· There will be an increase in the existing VAT registration thresholds for businesses from €37,500 for services and €75,000 for goods to €40,000 for services and €80,000 for goods respectively. To make it easier for business to avail of supports, a dedicated Tax Administration Liaison Committee (TALC) subgroup will be set up.

· A revised bank levy is being introduced for 2024. It will apply to those banks that received financial assistance from the State during the banking crisis, (AIB, EBS, Bank of Ireland and PTSB). It will have a revenue target of €200 million.

· 0.1 per cent will be added to all PRSI rates on 1st October 2024 to pay for the provision of State pensions following the decision not to increase the pension age.

In relation to agriculture:

· Consanguinity relief, which supports the transfer of farms from one generation to the next is being extended for a period of five years.

· The accelerated capital allowances for farm safety equipment are also being extended.

· The maximum aggregate lifetime limit of a number of farm-related reliefs is being increased to €100,000.

· The maximum amount of enhanced stock relief for farmers who are partners in a Registered Farm Partnership will be increased from €15,000 to €20,000 in line with EU regulations.

· The Land Leasing Income Tax Relief will be amended so that it only becomes available when the land has been owned for seven years so that it is better targeted to active farmers.

On the expenditure front:

· A €300 lump sum to recipients of fuel allowance in Q4 2023.

· An additional €200 will also be paid this year to recipients of the Living Alone Allowance

· For those in receipt of regular Social Protection payments, the Christmas Bonus will be paid in early December.

· There will be a once-off double week ‘Cost of Living Support’ payment to all qualifying Social Protection recipients. This will be paid in January and will include pensioners, carers, people on disability payments and jobseekers.

· A special, once-off payment of €400 will be made before Christmas to those who receive the Carer’s Support Grant, Disability Allowance, Blind Pension, Invalidity Pension and Domiciliary Care Allowance.

· The child benefit payment will be extended to 18-year-olds in full-time education.

· The weekly social welfare payment will be increased by €12.

· A double payment of Child Payment, worth an additional €140 for each child, will be made to all qualifying households before Christmas. A double payment of the Foster Care allowance will also be made this year.

· A €400 lump sum payment will be made to recipients of the Working Family Payment later this year.

· A lump sum payment to each child in receipt of the Qualified Child Increase

· An extension of the fee waiver on school transport services for a further year, an extension of the fee waiver for students sitting state exams, a €60 million capitation payment for schools to continue to meet increased running costs and funding for supports for the most disadvantaged groups.

· A once off reduction of the student contribution fee by €1,000 for free fees students; a once-off reduction of approximately 33 per cent in the contribution fee for apprentices in higher education and an increase in the Post Graduate Tuition fee contribution by €1,000 for student grant recipients.

· A €250 million package of temporary supports is being developed to support businesses through current challenges associated with Cost-of-Living pressures.

· An additional €35 million is being allocated to the Department of Enterprise, Trade and Employment. This additional €35 million in conjunction with the existing resources available to the department will allow the following measures:

€9 million to Local Enterprise Offices – the hubs for enterprise creation and business start-ups in local towns and communities – to allow them to extend their financial supports and mentoring programmes to a wider cohort of indigenous businesses.

€3 million for the Digital Services Coordinator to support enforcement of the Digital Services Act.

An increase in the IDA’s capital allocation of €27 million will accelerate its Regional Property Grants Programme, ensuring balanced regional inward investments.

FISCAL BACKGROUND TO BUDGET 2024

While the fiscal background to Budget 2024 is quite positive, recent weakness in corporation tax receipts and the concentration of corporation tax receipts in a small number of large multinational companies do sound a note of caution.

Estimates of Receipts and Expenditure for The Year Ending 31st December 2024 (Published 7th October 2023)

On the Friday before the budget the Department of Finance published estimated receipts and expenditure for end-2023, which will change as more data become available in the final quarter of the year; and receipts and expenditure for end-2024, which do not include the spending and taxation measures that will be announced on budget day.

The main point of note in this publication is the downward revision of €500 million in projected tax receipts this year, which reflects a projected undershoot of €750 million in corporation tax receipts. This reflects the relative weakness of corporation tax receipts in the August and September Exchequer returns. Despite this, the overall complexion of the public finances is still positive, with income tax still strong.

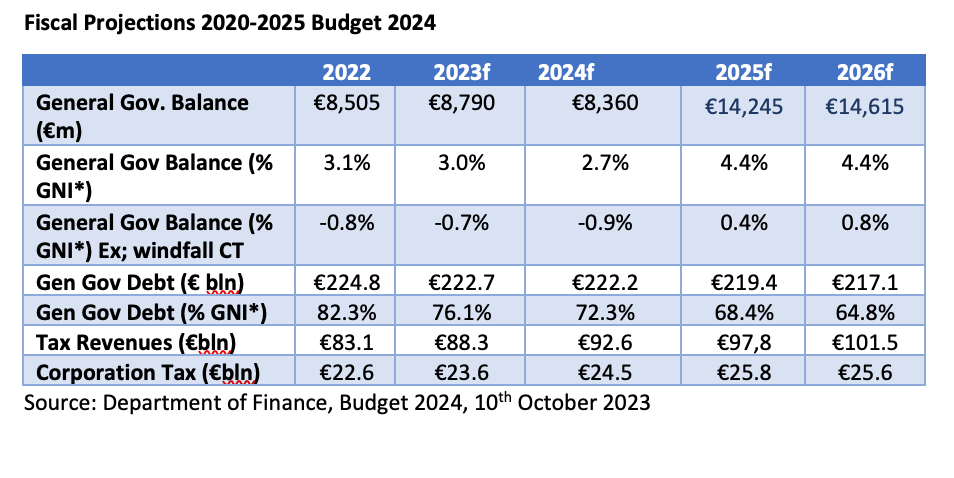

Before any Budget-day changes, an Exchequer surplus of €3.49 billion is projected for 2023 and a surplus of €9.4 billion for 2024. A General Government surplus of €9.6 billion is projected for 2023, equivalent to 1.8 per cent of GDP; and a surplus of €12.5 billion is projected for 2024, equivalent to 2.2 per cent of GDP. When the estimated windfall corporation taxes are excluded (that is the amount of corporate tax revenues that are regarded as once-off in nature or vulnerable), a General Government deficit of €1.18 billion is projected for 2023; and a surplus of €1.54 billion is projected for 2024.

[Note: The General Government balance measures the fiscal performance of the whole general government sector, which includes the Exchequer, the Social Insurance Fund, the non-commercial state-sponsored bodies, the Ireland Strategic Investment Fund, and the local authorities.]

The Exchequer Finances End-September

The last set of Exchequer returns ahead of Budget 2024 should give some cause for caution. The corporation tax situation has weakened over the past two months and this tax heading is finally starting to look somewhat vulnerable and quite volatile. This suggests that a cautious approach to the public finances and fiscal policy is now warranted. This uncertainty has not come at a good time for government as it prepares to deliver what is still likely to be an expansionary and high spending budget.

In the first nine months of the year, the Exchequer ran a surplus of €1.1 billion. This compares with a surplus of €7.9 billion in the same period last year. There was a transfer of €4 billion to the National Reserve Fund (NRF) in February this year, which has the effect of reducing the recorded surplus this year.

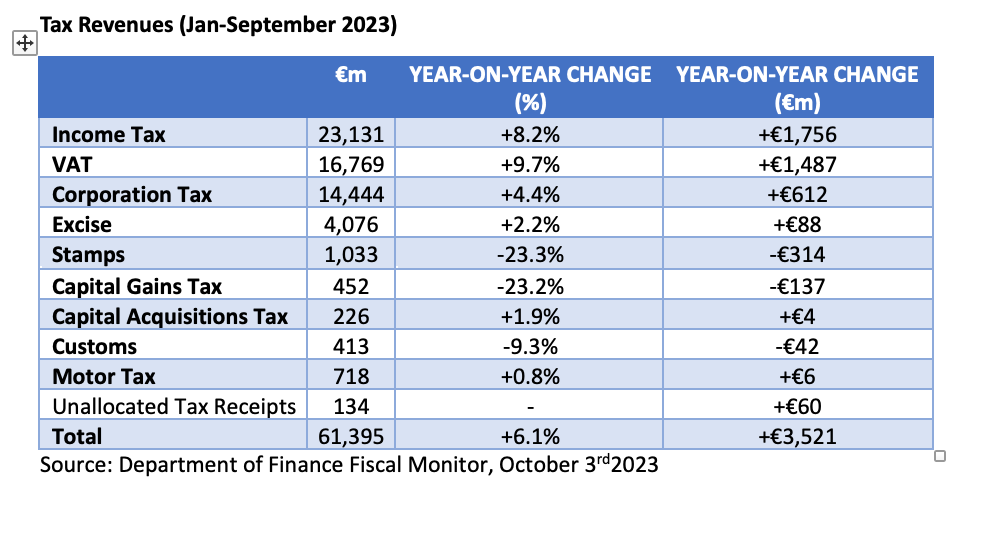

Tax receipts of €61.4 billion were collected to end-September, ahead of the same period last year by €3.5 billion or 6.6 per cent, driven primarily by growth in income tax, VAT, and corporation tax.

In the first nine months of the year, income tax receipts totalled €23.1 billion, which was €1.8 billion or 8.2 per cent higher than the same period in 2022. This reflects the ongoing strength of employment and growth in wages.

The VAT take was up by €1.5 billion, or 9.7 percent. This reflects the ongoing strength of consumer spending. New car registrations in the first nine months of the year were 16.5 per cent higher than in the first nine months of 2022.

The main area of concern in the Exchequer finances is the sharp slowdown in corporation tax receipts over the past two months. In the first nine months of the year, corporation tax receipts totalled €14.4 billion, which is €612 million or 4.4 per cent ahead of last year. However, corporation tax receipts in September were €252 million or 12.4 per cent lower than last year. In the two-month period August and September, corporation tax receipts totalled €3.6 billion, which is 26.1 per cent or €1.3 billion lower than the equivalent two-month period in 2022. While it is still too early to jump to any conclusions based on two month’s data, the performance of ICT and Pharmaceutical companies will need to be monitored closely. In the first nine months of the year, corporation tax is €0.7 billion behind what the Department of Finance had budgeted for.

Gross voted current government expenditure in the first nine months of the year at €58.5 billion was €3.9 billion or 7.1 per cent higher than the equivalent period last year. It was €1 billion ahead of what the Department had budgeted for.

ECONOMIC AND FISCAL FORECASTS UNDERLYING BUDGET 2024

The following are the economic assumptions underlying Budget 2024. The Department is forecasting reasonable levels of real domestic growth out to 2026; increasing employment; and low levels of unemployment.

The medium-term fiscal projections underlying the budget project strong surpluses out to 2026 and a steady decline in the government debt/GNI* ratio. The vulnerability of the public finances to what the Department of Finance regards as windfall corporation tax receipts should be noted.

Despite the concerns about the vulnerability of corporation tax receipts, the take under this heading is anticipated to remain strong out to 2026.

GLOBAL BACKGROUND TO BUDGET 2024

The external global economic and financial background against which Budget 2024 was framed is both uncertain and risky. It continues to be dominated by the stubborn nature of inflation; renewed pressure on energy prices; ongoing interest rate tightening; tight labour markets; the challenged Chinese economy; slow growth in Germany; the ongoing Ukrainian war; and intense global geo-political tensions, particularly between China and the US, but Israel has now come to the fore. For the small, open, and very globalised Irish economy there are threatening headwinds that cannot be ignored.

Just as the budget was being presented, the International Monetary Fund (IMF) cut its growth rate for the Euro Zone and China and said overall global growth remains low and uneven, despite the strength of the US economy. The global growth forecast for 2023 was left unchanged at 3 per cent, but the forecast for 2024 was pared back by 0.1 per centage point to 2.9 per cent. Growth for the Euro Zone is forecast at 0.7 per cent in 2023 and 1.2 per cent in 2024. This is down from the most recent growth forecast of 0.9 per dent and 1.5 per cent respectively in July.

The Euro Zone

In September the ECB delivered its tenth successive interest rate increase, which has seen a cumulative increase of 4.5 per cent in rates since the end of July 2022. Following the latest rate increase the ECB president Christine Lagarde suggested that rates may now be at or very close to their peak, but that rates will remain at current historically high levels for a prolonged period. One cannot say definitively that rates will not rise further as that will really depend on how the economic and inflation data behave over the coming weeks. At this juncture the risk of some further modest tightening appears quite high, although given the Euro Zone growth performance, the ECB would now be best advised to stand back and gauge the impact of the cumulative rate increases seen over the past year.

Headline inflation in the Euro Zone declined to 4.3 per cent in September, which is still well above the desired 2 per cent target, but it is down significantly from a peak of 10.6 per cent in October of last year. The problem is that much of this decline has been driven by declines in oil and gas prices. Core inflation, which excludes energy, food, tobacco, and alcohol is still running at an unacceptably high 4.5 per cent. Of particular concern is the inflation rate of 4.7 per cent in the services sector. This is exactly the situation in Ireland, where service sector inflation is running at 9.5 per cent and goods inflation at just 2.5 per cent.

Service sector inflation across the Euro Zone, and indeed in the US, is being driven by the tightness of labour markets. The unemployment rate in Ireland is close to a historic low of 4.2 per cent, and 6.4 per cent in the Euro Zone, which is the lowest since the euro was created in 1999. The ECB would like to see unemployment rise and would regard this as a price worth paying to bring inflation back under control.

Other indicators of activity in the Euro Zone suggest weakness, particularly in manufacturing activity, which is a particularly important sector in Germany. The Purchasing Managers Index (PMI) for manufacturing in the Euro Zone in September was at 43.4 and the PMI for services at 48.4. These indices are constructed on the basis that a reading above 50 means that more firms are expanding rather than contracting, and a reading below 50 suggests more firms are contracting than expanding. Manufacturing is clearly facing immense challenges, while service sector activity is now trending weaker.

GDP growth in the Euro Zone declined by 0.1 per cent in the final quarter of 2022, and it increased by just 0.1 per cent in the first and second quarters of 2023. These data are suggestive of an economy that is bouncing along the bottom, and inflation is gradually but stubbornly moving towards its target.

The German economy is a particular cause for concern, as it has weakened quite dramatically over the past year. GDP stagnated in the second quarter, following two consecutive quarters of decline. The Purchasing Managers Index (PMI) for manufacturing was at 39.8 in September and the PMI for services was at 49.8. The influential Ifo index of business sentiment weakened further in September. Germany is now being described as the ‘sick man of Europe’ and is struggling due to its heavy dependence on manufacturing and the associated energy dependence. The demographic profile is also a significant structural impediment to growth.

The United States

The Federal Reserve left interest rates unchanged at the September meeting in the target range of 5.25 per cent-5.5 per cent. The FOMC stated that it remains highly attentive to inflation risks and that the economy is proving to be more robust than expected, and certainly sent a strong message that a further rate increase is possible over the coming months. It said that inflation remains elevated; job gains have slowed but remain strong; the banking system is sound and resilient, but tighter credit conditions for households and business are likely to weigh on economic activity, hiring and inflation over the coming months. Higher for longer appears to be the main interest rate message.

The unemployment rate is at a low 3.8 per cent; headline inflation is at 3.7 per cent and core inflation is at 4.3 per cent; the manufacturing PMI stood at 48.9 in September and the services PMI stood at 50.2; and the economy expanded at an annualised rate of 2.1 per cent in the second quarter. US growth has slowed but is still considerably stronger than the Euro Zone.

United Kingdom

The Bank of England also left its base rate unchanged at 5.25 per cent at the September 21st meeting of the Monetary Policy Committee (MPC). The MPC is adopting a wait and see approach for the moment but has reiterated its commitment to tighten monetary policy further if deemed necessary. The UK economy expanded by a stronger than expected 0.2 per cent in the second quarter, following growth of 0.3 per cent in the first quarter. The PMI for manufacturing stood at 44.2 in September and the services index stood at 47.2. Headline inflation eased to 6.7 per cent in August, which is the lowest rate since February 2022. The core rate of inflation eased to 6.2 per cent. The UK economy is fundamentally weak.

Oil Prices

Oil prices have been edging up in recent weeks. Brent crude oil prices recently breached $95 per barrel for the first time since November 2022. That is up almost a third, from a low of around $72, touched as recently as June. The steep and sudden climb in oil prices is entirely due to the determination of a new alliance between Saudi Arabia and Russia. The oil markets are concerned that output cuts by Saudi Arabia and Russia could cause a global supply shortfall. Both countries have jointly agreed to cut oil output to achieve a target price of $100 a barrel. Motivation is obvious: Russia needs the money to keep financing the war. Saudi Arabia justified its decision to cut back supply based on uncertainties such as future demand from the slowing Chinese economy.

An oil price rise of this magnitude, if sustained, used to be called an oil ‘shock’ and would have prompted headlines about reduced economic growth and inflation problems. $100 oil could be enough to tip Europe into recession via even higher interest rates. This upward trend in oil prices could arrest the deceleration of inflation and will worry central bankers. Oil prices have edged down again in the first week of October as the markets started to factor in lower global growth, but the conflict in Israel and the implications for the wider region have added fresh upward pressure to oil prices. The bottom line is that energy markets generally look very nervous and volatile.

Government Bond Yields

A key feature of financial markets in recent weeks has been the renewed upward pressure on bond yields. The US 10-year bond yield recently breached 4.5 per cent for the first time since 2007 and is moving towards 5 per cent; the German 10-year yield is at 2.98 per cent, which is the highest level since July 2011 and is up from -0.4 per cent just two years ago; and the UK 10-year yield is up at 4.63 per cent. Bond yields are largely rising on the back of concerns about elevated inflation; central bank rates remaining higher for longer; and the pushing out of the timing of the first interest rate cut by central bankers. Higher bond yields will increase government debt servicing costs but will also affect property prices and general economic activity. Rising bond yields should also logically pose a significant threat to equity markets.

THE DOMESTIC BACKGROUND TO BUDGET 2024

The Irish economic performance has proven quite resilient despite the many global and domestic headwinds over the past couple of years.

GDP contracted by 0.9 per cent in the final quarter of 2022 and it contracted by 2.6 per cent in the first quarter of 2023. Consequently, this satisfies the technical definition of a recession. However, the reality is that GDP is a distorted measure of activity in the Irish economy due to the activities of the very important multi-national sector. It expanded by 0.5 per cent in the second quarter of 2023.

Modified Domestic Demand (MDD) is an important and more representative measure of underlying demand and excludes Intellectual Property (IPP) transactions and aircraft leasing-related globalisation effects. MDD is a broad measure of underlying domestic activity that covers personal, government, and domestic investment spending. It contracted by 0.2 per cent in the final quarter of 2022 and the first quarter of 2023 but expanded by 1 per cent in the second quarter of 2023. Within this, personal spending on goods and services, a key measure of domestic economic activity, increased by 1 per cent in the final quarter of 2022; was flat in the first quarter of 2023; and expanded by 0.9 per cent in the second quarter of 2023.

The reality is that output and exports from the Chemical and Pharma sector have weakened significantly this year, due to a post-Covid adjustment after very strong growth during the pandemic. This is being reflected in the weaker export performance so far this year. In the first 7 months, exports declined by 2.5 per cent, with the Medical and Pharmaceutical products component down by 0.7 per cent.

In the June to August quarter, overall manufacturing output declined by 11 per cent, with the ‘modern component’ (dominated by FDI) down by 14.2 per cent, while the traditional component’ increased by 5.6 per cent. This weaker trend in the output and exports from the ‘modern sector’ is a significant part of the explanation for the under-shoot in corporation tax receipts.

The overall picture is confusing and needs careful interpretation, but the bottom line is that indicators such as the labour market; consumer spending, the Exchequer finances and domestic business investment are all suggesting an ongoing strong level of economic activity, but the risks to growth are now obvious.

The Labour Market

The Irish labour market continues to perform strongly and is operating very close to full employment.

In the second quarter of the year, employment reached a record high of 2,643 million, which is up by 3.5 per cent or 88,400 on a year ago. The employment rate for females stood at a record high of 70.5 per cent and the overall employment rate stood at a record high of 74.2 per cent.

The unemployment rate in September increased modestly to 4.2 per cent of the labour force. This compares to 4.4 per cent a year ago. The unemployment rate for males stood at 4.4 per cent and for females at 4 per cent. The youth unemployment rate (15-24 years) stood at 11.9 per cent. It seems inevitable that the labour market should weaken somewhat over the coming year.

Inflation

The annual rate of consumer price inflation peaked at 9.2 per cent in October 2022. It subsequently decelerated to 5.8 per cent in July 2023, but jumped by 0.7 per cent in August, to give an annual rate of 6.3 per cent. Higher global energy prices pushed petrol and diesel prices up during the month of August. The concern is that global energy and food prices could come under pressure over the coming months and inflation could prove difficult to bring down to acceptable levels.

The decision of Government to increase the special VAT rate from 9 per cent to 13.5 per cent, and to increase the excise duty on fuels on 1st September will also contribute to higher prices.

Consumer Dynamics

Consumer spending has held up well in 2023, but there has been some easing. In the first 8 months of the year the value of retail sales increased by a strong 10.7 per cent and the volume of sales expanded by 5.6 per cent. When strong car sales are excluded, the value of retail sales expanded by 5.1 per cent and the volume of sales expanded by 1.3 per cent. The stronger value growth reflects high consumer price inflation.

Consumer confidence weakened in August and September as cost-of-living pressures and rising interest rates increasingly impacted.

The Property Market

Against a background of sharply rising mortgage rates and affordability issues, national average residential property prices have been moderating since late 2022.

· National average residential property prices increased by 1.5 per cent in the year to July but increased by 0.3 per cent during the month. The annual growth rate is down from a peak growth rate of 15.1 per cent in March 2022.

· Average residential property prices Outside of Dublin increased by 3.8 per cent in the year to July but increased by 0.4 per cent during the month. The annual growth rate is down from a peak growth rate of 17.1 per cent in March 2022.

· Average residential property prices in Dublin declined by 1.4 per cent in the year to July but increased by 0.2 per cent during the month. The annual growth rate is down from a peak growth rate of 13.2 per cent in February 2022.

· CSO data show that private rents increased by 7.1 per cent in the year to August 2023. Between June 2012 and August 2023, average private rents increased by 109.3 per cent. Data from the Residential Tenancies Board (RTB) show that rents on new tenancies increased by 8.9 per cent in the year to the end of the first quarter of 2023.

Supply of residential property is the key problem that has not attracted anything like the sense of urgency required for at least a decade. Housing needs to be viewed as an essential element of national economic competitiveness.

CONCLUSIONS

The Irish economy continues to perform quite strongly, with the labour market, tax revenues and consumer spending all suggesting reasonable levels of economic activity. The export performance of the multi-national sector is undergoing an adjustment after a prolonged period of extreme buoyancy. This will take from the GDP performance in 2023.

There is still considerable uncertainty prevailing, with a slower global economy; rising interest rates; the elevated level of consumer prices all posing challenges.

The key positives for the economy include:

· Strong Economic Momentum.

· Record Levels of Employment.

· Low Unemployment.

· Strong FDI Performance.

· Stable Banking System.

· Strong Public Finances.

· Record Household Deposits, lower levels of household debt and in general, a strong personal balance sheet.

The key threats and challenges to the wellbeing of the economy include:

· The uncertain and risky external economic environment.

· Rising interest rates.

· Cost-of-living pressures.

· Cost-of-doing business pressures.

· The housing market.

· Global technology pressures, although many technology workers losing their jobs in Ireland are being hired by other sectors that have struggled to hire IT workers in recent years.

· Global geo-political uncertainty.

· Rapidly rising bond yields.

Budget 2024 is a stimulatory package and will provide support to the overall economy in 2024.

THIS PUBLICATION IS BASED ON DATA AVAILABLE UP TO AND INCLUDING 10th OCTOBER 2023.